kentucky income tax calculator

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Kentucky tax forms are sourced from the Kentucky income tax forms page and are updated on a yearly basis.

Kentucky Income Tax Calculator Smartasset

For most counties and cities in the Bluegrass State this is a percentage of taxpayers.

. Kentucky is one of these states. This tool was created by 1984 network. So the tax year 2022 will start from July 01 2021 to June 30 2022.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Kentucky State Income Tax Calculator In the United States there are nine states that have a flat income tax. The 2022 state personal income tax brackets are updated from the Kentucky and Tax Foundation data.

Marginal tax rate 24. Underpayment of Estimated Income Tax or Limited Liability Entity Tax LLET for tax years beginning on or after January 1 2019- The amount of the underpayment or late payment of Kentucky estimated income tax or LLET multiplied by the tax due interest rate. The bracket threshold varies for single or joint filers.

If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income. Kentucky Income Tax Calculator 2021.

If the AMT tax calculation results in an amount that is greater than your normal income tax you owe the difference as AMT. Support Education Excellence in Kentucky SEEK 310154. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Annual 2019 Tax Burden 75000yr income Income Tax. Your AMT tax is calculated as 26 of AMTI up to 199900 99950 for married couples filing separately plus 28 of all AMTI over 199900 99950 for married couples filing separately. Aging and Independent Living.

The penalty is computed separately for each installment due date where there was an. Enter your state individual income tax payment. Important note on the salary paycheck calculator.

Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Switch to Kentucky hourly calculator. Before the official 2022 Kentucky income tax rates are released provisional 2022 tax rates are based on Kentuckys 2021 income tax brackets.

The tax rate is five 5 percent and allows itemized deductions and certain income reducing deductions as defined in KRS 141019. A full-year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the. Education and Workforce Development.

The Kentucky income tax rate is 5 for all personal income. Effective tax rate. If you would like to help us out donate a little Ether cryptocurrency to.

Kentucky Salary Paycheck Calculator. Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Kentucky paycheck calculator.

The Kentucky tax calculator is updated for the 202223 tax year. The calculator on this page is provided through the ADP. Remember paying your SUI in full and on time qualifies you to get a whopping 90 off of your FUTA tax bill so make sure you pay attention to the due dates.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Search Save Online Today. Unless youre in construction then your rate is 10.

If youre a new employer youll pay a flat rate of 27. Kentucky Income Tax Calculator 2021. The tax rate is the same no matter what filing status you use.

Kentucky imposes a flat income tax of 5. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Kentuckys individual income tax law is based on the Internal Revenue Code in effect as of December 31 2018.

The Kentucky income tax calculator is designed to provide a salary example with salary deductions made in Kentucky. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Ad Find discounts on Ky state tax calculator. Download Or Email Form 740-ES More Fillable Forms Register and Subscribe Now. The wage base is 11100 for 2022 and rates range from 05 to 95.

Calculate your net income after taxes in Kentucky. 25000 income Single with no children - tax 1136 35000 income Single parent with one child - tax 1676 50000 income Married with one child - tax 2526 60000 income Single parent with one child - tax 3126 80000 income Married with two children - tax 3251. Details of the personal income tax rates used in the 2022 Kentucky State Calculator are published below the.

Figure out your filing status. Select an Income Estimate OR. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes.

The KY Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in KYS. The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Kentucky State Income Tax Rates and Thresholds in 2022. Overview of Kentucky Taxes.

Select an Income Estimate.

Kentucky Income Tax Calculator Smartasset

Tax Withholding For Pensions And Social Security Sensible Money

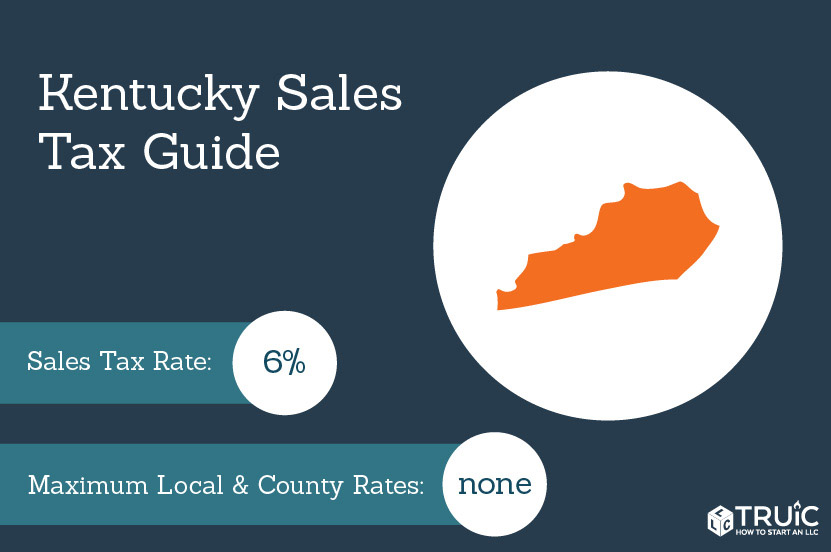

Kentucky Sales Tax Small Business Guide Truic

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Capital Gains Tax Calculator 2022 Casaplorer

Income Tax Calculator 2021 2022 Estimate Return Refund

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Jefferson County Ky Property Tax Calculator Smartasset

Kentucky Income Tax Calculator Smartasset

Income Tax Calculator 2021 2022 Estimate Return Refund

Income Tax Calculator Estimate Your Refund In Seconds For Free

Cryptocurrency Taxes What To Know For 2021 Money

Kentucky Paycheck Calculator Smartasset

Tax Calculator For Items Deals 60 Off Www Ingeniovirtual Com

Llc Tax Calculator Definitive Small Business Tax Estimator

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Kentucky Income Tax Brackets 2020

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price